How to Be a Price Maker Instead of a Price Taker

By Tim Williams

Most firms feel they’re stuck on a treadmill when it comes to agency compensation. Actually, it’s more of a time warp. That’s because the cost-plus model employed in most agency-client agreements dates back to the early days of the industrial age.

In the mid-1800’s, the owners of newly-mechanized factories were confounded as to how they should price their products. Machines were now doing the work of humans, and it wasn’t at all clear how this should be valued. So these first titans of industry sent early versions of accountants into their factories to calculate the cost of production — materials, labor, and overhead. To this, factory owners would add a desired profit margin: the birth of cost-plus pricing.

THE (R)EVOLUTION OF PRICING

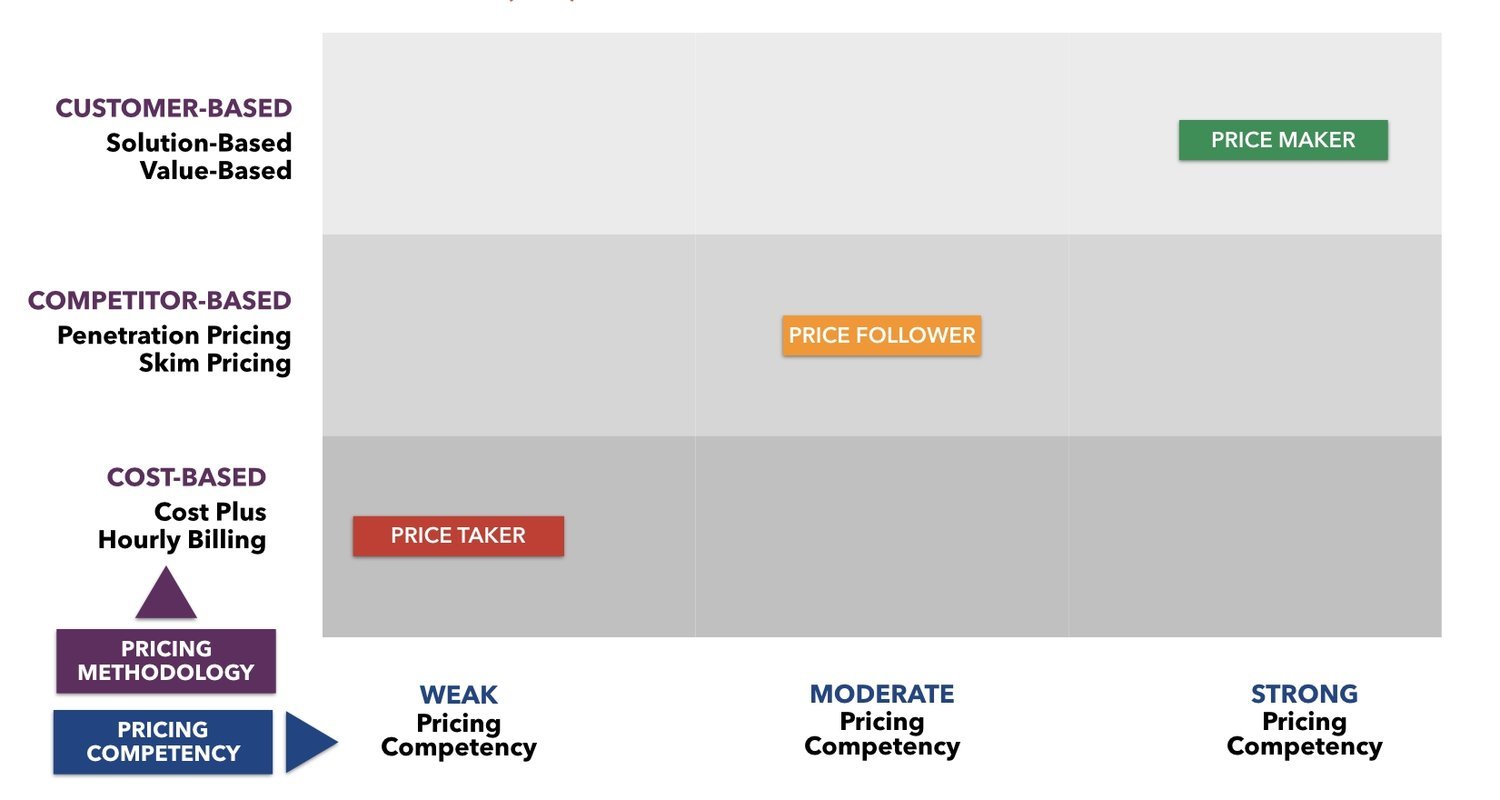

The cost-plus model is now well over 150 years old. And it’s a sure bet that not a single one of your clients use it as their pricing strategy. Most businesses have all moved on to at least “competitor-based” pricing, which looks at current market dynamics and sets prices based on factors like supply and demand.

But most modern companies have moved even beyond that to what is now the state-of-the-art in pricing: customer-based. Customer-based pricing is built around the truth that value is determined by the utility to the customer, not the cost to the seller.

So it’s no wonder that most agencies and other professional firms feel like “price takers.” If your pricing is determined by your costs (hourly rates), then you might as well sit back and let procurement and their mastery of Excel spreadsheets do the pricing for you.

Could your firm ever become a “price maker?” Absolutely. But first, it means moving away from an industrial age paradigm of value. Then, it requires committing to making pricing — not costing — a core competency in your firm.

Your clients have a pricing function that is entirely separate from their accounting functions. Many have a chief pricing officer in addition to a chief financial officer. Their finance professionals are in charge of counting and managing costs. Their pricing professionals are responsible for estimating and maximizing value.

PLAY OFFENSE INSTEAD OF DEFENSE

By mistaking costing for pricing, agencies have become subservient and reactive, constantly on the defense instead of the offense when it comes to getting paid for the value they create. It’s not only possible to break the cycle, it’s absolutely imperative to ensure the financial health and survival of your firm.

Step one is to regain your confidence as a seller. It’s the seller, not the buyer, that determines pricing strategies. Your clients cannot tell you how you should price your services. They can certainly decide not to do business with you, but this will almost always be driven by factors other than your pricing strategy.

Indeed, many brands are now clamoring for new and better ways to pay their marketing partners. And they’re waiting for you to make the first move. It’s not their job to develop innovative compensation approaches; it’s yours.

Becoming a “price maker” requires that you take pricing out of the hands of finance people and engage the brainpower of the creative and strategic talent in your firm. When you have a new assignment or new client, gather your core team and ask the question, “If time-based billing wasn’t an option, how else could we get paid for the value we’re about to create for this client?” You’ll be amazed at the inventive thinking that emerges.

In our consulting work with agencies and other professional firms around the world, we’ve seen an amazing variety of effective, imaginative approaches that have nothing to do with tracking and billing for time. This growing list includes such methods as:

* Fixed price options

* Royalties

* Output-based

* Dynamic pricing

* Subscription-based

* Sprint-based

* Points-based

* Usage-based

* Outcome-based

And many more …

Don’t be dissuaded from experimenting with pricing based on the illusion that it’s too risky. Given the steady decades-long decline in agency profitability, the greatest risk by far is staying with the current shopworn system.